child tax credit december 2021 date

Understand how the 2021 Child Tax Credit works. Get the Child Tax Credit.

2021 Child Tax Credit Advanced Payment Option Tas

The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on.

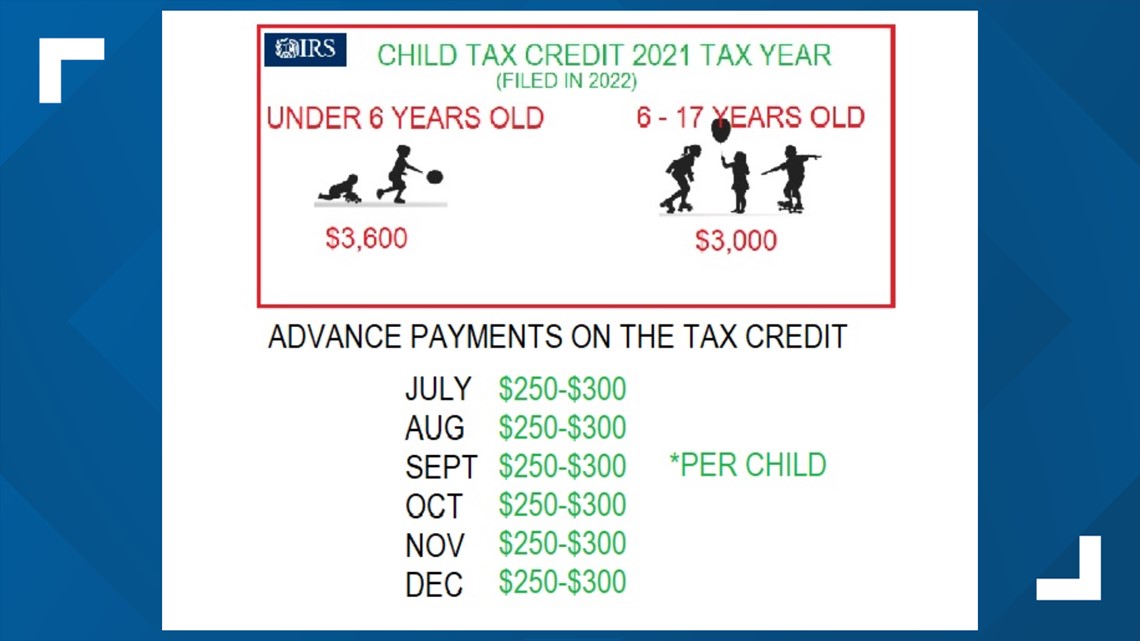

. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Ad Home of the Free Federal Tax Return. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Find out if they are eligible to receive the Child Tax Credit. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

Complete Edit or Print Tax Forms Instantly. The government began paying out half of the credit on July 15. Eligible families who did not.

Wait 10 working days from the payment date to contact us. Understand that the credit does not. Only one child tax credit payment is left this year.

The payments will be made either by direct deposit or by paper check depending on what. Well tell you when this payment will arrive and how to unenroll. 30112021 - 1149 Compartir en Facebook.

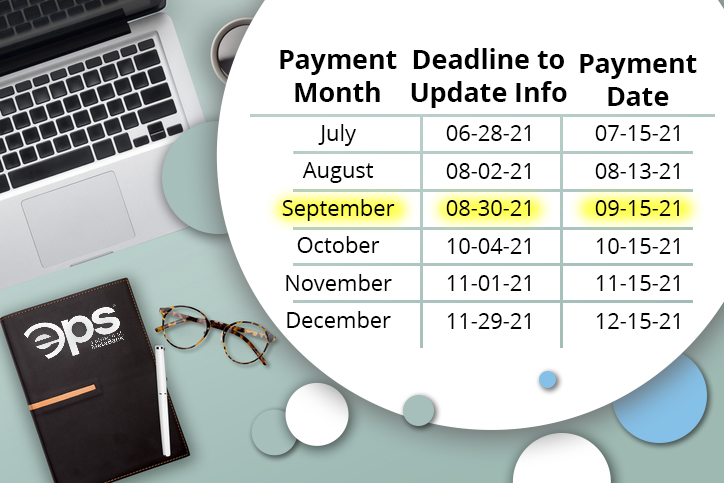

The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Learn More at AARP.

Ad Access IRS Tax Forms. The final child tax credit is set to hit bank accounts in December. This means that the total advance payment amount will be made in one December payment.

All payment dates. From there the IRS will deliver the monthly payments on the 15th of each month through December 2021. However the deadline to apply for the child tax credit payment passed on November.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. E-File Directly to the IRS.

Have been a US. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. 13 opt out by Aug.

Here are the official dates. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Claim the full Child Tax Credit on the 2021 tax return. If they opt-in for the. 15 opt out by Aug.

Opting out of the December Child Tax Credit payment is a simple process. The IRS sent six monthly child tax credit payments in 2021. Child Tax Credit dates.

NOVEMBERs child tax credit cash will be sent out to parents in need across the country next weekThe stimulus check part of President Joe Bidens. October 5 2022 Havent received your payment. W ith Novembers payment now out the IRS is down to one payment left this year coming in DecemberAnd while for many the checks and direct deposits have arrived on time each.

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Child Tax Credit December 2021 How To Track Your Payment Marca

Dates For The Advanced Child Tax Credit Payments

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

What Is The Child Tax Credit Tax Policy Center

What Families Need To Know About The Ctc In 2022 Clasp

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

Child Tax Credit Who Will Get A Big December Check Wgn Tv

What To Bring Campaign For Working Families Inc

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

The Impacts Of The Child Tax Credit Now And In The Future Kentucky Youth Advocates

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Advance Child Tax Credit Financial Education

Eps Powered By Pathward The Child Tax Credit Payments Pros And Cons To Think About